If you mention the name “Rex” to a European, they might immediately think of the much-loved and admired German Shepherd police dog who solved crimes in a popular TV show Kommissar Rex. Though the show went off the air in 2015, two years later “REX” is reborn; but this time as a different way to solve a recurring dilemma. The Registered Export System (REX) of the European Union is the latest complex — and perhaps most creative — invention of the EU. In a bold move to modernise the export process to be faster and easier, the E.U. adopted the new self-certification REX system on January, 2017. The REX system is intended to improve cross-border transactions for the international trade community, and to positively impact some developing economies.

International trade creates opportunities for developing countries to build their economies into financially stable, inclusive ones; a far cry from the protectionist stance many countries are taking in the wake of the Brexit and rhetoric from the recent U.S. election trail.

One stepping stone towards economic growth is the Generalised System of Preferences (GSP), the largest trade preference program supported by the EU, U.S. and many other nations. GSP promotes economic development by eliminating duties on thousands of products when they are imported from designated GSP beneficiary countries and territories. In 2015, duty-free exports entering the U.S. under its GSP program totalled nearly $17.7 billion (£14 billion).

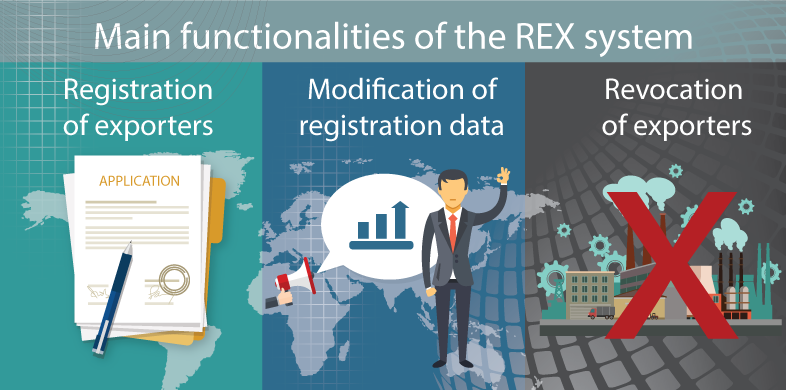

Currently, the requirement to produce certificates of origin is built into preferential trade arrangements of the EU. The REX system is based on a principle of self-certification by GSP exporters, who will provide their own statements on origin directly to their customers.

REX gives GSP beneficiary countries that are exporting goods much easier access to the EU markets, thus contributing to their economic growth.

One global exporter said “This [REX] scheme will be able to reduce the workload and save time and cost for exporters. It will eventually benefit the export sectors and make the business activity easier.”

The rewards from REX

REX was first introduced as part of the GSP requirements for rule of origin in 2010. While other elements of the reform took effect as early as 2011, the application of REX was deferred until 2017 to give GSP beneficiary countries time to get ready.

The new self-certification REX system will be phased in by 2020 but is effective immediately, providing importers, exporters and manufacturers the opportunity to streamline the GSP qualification process. REX will eventually replace the current GSP requirement for origin certifications issued by governmental authorities, and on invoice declarations made out under certain conditions. Currently, imports from GSP beneficiary countries are entitled to preferences if accompanied by a GSP certificate Form A or an appropriate invoice declaration.

Exporters from GSP beneficiary countries will need to register with their competent authorities to receive an individual REX number. For preferences to be claimed on imports into the EU, the REX number must be declared together with a statement of origin unless the value of the consignment falls below $6,350 (£5034).

The EU will be providing access to a central database containing the details of all the REX traders within the EU and GSP beneficiary countries. The database will be published here.

If a company exports raw materials or components to a GSP beneficiary country that has implemented REX, and the materials are incorporated into a product before being imported into the EU, under GSP the company must also register with its local customs authorities. It may also need to register if sending those GSP goods on to other EU Member States, Switzerland, or Norway.

Winners and losers

There will be a transition period to allow exporters to be registered. Until a GSP beneficiary country is officially implementing REX, GSP certificates and invoice declarations can be presented to claim preference and the current procedures and codes still apply.

As of January, 2017, Iraq, the Marshall Islands, Tonga, and Fiji lost their benefits because they are now deemed ‘upper-middle income’ countries. Cameroon and Georgia lost their GSP status because of Free Trade type arrangements they now enjoy with the EU. Additional countries who are losing GSP include Botswana, Namibia, Turkmenistan, Peru, Colombia, Honduras, Nicaragua, Panama, Costa Rica, El Salvador, and Guatemala (now all covered by the EU bilateral agreement).

The EU GSP tariff benefits do not cover all products exported from a GSP-eligible country. Some industries in GSP countries are doing much better in the types of products exported, which is taken into account when deciding on granting unilateral preferential treatment. As such, some product groups have lost GSP preferences even though the country remains eligible.

In 2017, for example, products groups which will lose their GSP preference include mineral products, inorganic/organic chemicals, textiles, iron/steel, motor vehicles, bicycles, aircraft and spacecraft, ships, and boats originating in India. For Indonesia, live animals and animal products (excluding fish), animal or vegetable oils, fats, and waxes lose GSP preference. This affects Kenya’s live plants and floricultural products, while Ukraine is impacted on a list of products including railway and tramway vehicles and products, animal or vegetable oils, fats, and waxes.

The REX benefits

Myanmar’s explosive economic growth and untapped potential have led many to dub the country as ‘Asia’s final frontier.’ After decades of isolation and brutal military dictatorship, Myanmar is emerging, becoming the world’s fastest-growing economy in less than six years, according to the IMF.

Myanmar will be applying for the REX system by January 1, 2018. While the U.S. reinstated the country’s eligibility for benefits under the GSP program on November 13, 2016, Myanmar regained similar preferential trade benefits under EU’s GSP program in July 2013. Other major economies, such as Canada, Japan, Korea, and Australia, have also included the country in their GSP programs.

As a United Nations-listed Least Developed Country, Myanmar’s per capita income is at $1,280 (£1015), the second-lowest in East and Southeast Asia. Over 25% of the population lives below the national poverty line.

The GSP designation will give Myanmar the opportunity to export thousands of products to the EU and other countries duty-free. Regaining GSP trade benefits will spur economic development, generating opportunities for exports that create jobs and help reduce poverty in the formerly-closed economy.

Playing the long game

Companies implementing REX should first analyse their supply chains and look into the effects of the REX system on their business processes. They should give special attention to the exporters in GPS countries that have already implemented the REX system. As the role of the issuing authority in the beneficiary country changes — from issuing legal certificates of origin to validating applications to REX to checking the correctness of origin statements made — the EU importer has to fully rely on the statement of the exporter and his ability to apply the rules of origin correctly.

Some global trade management solutions can help. They publish the relevant customs forms, statements, and certificates as templates along with all document requirements for import and export controls, taxes, duties, and fees that may be requested by the EU or its Member States. This includes the template of what the correct origin statement for REX should look like.

Global companies recognise that substantial costs-savings can only be leveraged with a superior system that deciphers complex terms, coverage and rules of origin for trade agreements while still maintaining the highest levels of compliance. The REX system is a potential cost-savings solution for businesses that will also help reduce documentation burdens, simplify procedures, and improve the ease of doing business.