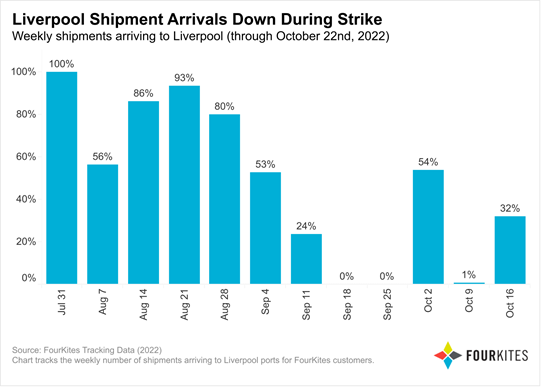

At Liverpool, FourKites has seen the number of shipments arriving to the port (including exports, imports, and transshipment stops) vary drastically with the strikes that began on 19 September and 11 October.

FourKites saw shipments arriving to Liverpool decrease by 55% week-over-week during the week of 11 September before the first strike began, an indicator that shippers were potentially avoiding the Port of Liverpool due to the impending strike action.

FourKites saw shipments plummet during the weeks of 18 and 25 September during the first strike, as well as during the week of 9 October during the second strike.

Weekly shipments arriving to the Port of Liverpool during the weeks of 2 and 16 October were down by 46% and 68% respectively when compared to the beginning of August.

After the first port worker strike began at the Port of Felixstowe, FourKites saw a significant increase in days at terminal for containers currently at the facility. On 21 August (the day the first strike began), ocean shipments (including import/export/transshipment) at the Port of Felixstowe had been at terminal for 5.4 days on average for FourKites customers.

By 30 August, this had increased to a peak of 10.3 days on average, a 91% increase. After the initial strike ended, average days at terminal at Felixstowe decreased down to 3.8 days on average, though the onset of the second strike on 27 September has since caused this to increase again by 139% to 9.1 days as of 10 October.

Over this period, a collection of major European ports (including Rotterdam, Bremerhaven, Hamburg, and Antwerpen) has remained mostly stable, with the 7-day average days at terminal at 6.0 days as of 17 October.

During the initial Felixstowe strike, FourKites saw shipment arrivals to Felixstowe decrease from 20% of all U.K. port arrivals (during the week of 7 August) to 0%.

During this time period, it appears that many shipments may have been rerouted to other ports in the U.K. such as Southampton, which saw an increase from 13% to 24% over the same two-week period. Felixstowe has also seen another decrease in shipment arrivals as the second strike began, decreasing by 57% week-over-week.

Commentary from Glenn Koepke:

Do you expect the Liverpool strike to have similar impacts as Felixstowe?

Liverpool won’t help the current situation as we will see an increase in delays as well as

container volume shift. It won’t have as significant an impact as what we saw with Felixstowe starting 21 August. All parties need to be in constant communication with each other, shippers and BCO’s are leveraging other ports and building buffer into their demand plans to offset these continual disruptions for freight coming through the UK ports.

How do current dwell times compare to historical averages for this time of year? Assuming data doesn’t reflect anything out of normal:

Dwell times are still within tolerance and not shutting down production facilities or customer orders. However, these delays compound with other upstream and downstream noise in the system. One example is order lead time to customers. If there are production part availability issues, staffing issues, truck delays, and now port delays, we are seeing cases where an end-to-end transit time may go from 15 or 30 days to now 20-45. This makes planning and forecasting extremely difficult for all parties.

Any other thoughts/comments or things to watch for?

With the softening global economy, keep an eye out for carriers deciding to downsize their fleets, delay capital investments, and re-focus around new strategic areas. This applies to both the EMEA market and the US freight markets.

To read more news and exclusive features see our latest issue here

Never miss a story… Follow us on:

![]() International Trade Magazine

International Trade Magazine

![]() @itm_magazine

@itm_magazine

![]() @intrademagazine

@intrademagazine

Media Contact

Anna Wood

Editor, International Trade Magazine

Tel: +44 (0) 1622 823 922

Email: editor@intrademagazine.com